BTC Price Prediction: Path to $200,000 Supported by Technical and Fundamental Factors

#BTC

- Technical Strength: BTC trading above critical support with positive MACD momentum suggests underlying bullish sentiment

- Institutional Momentum: Major banking partnerships and potential S&P inclusion creating sustained demand pressure

- Macro Tailwinds: Federal Reserve rate cut expectations and global liquidity increases providing favorable conditions for Bitcoin appreciation

BTC Price Prediction

Technical Analysis: BTC Shows Bullish Momentum Above Key Support

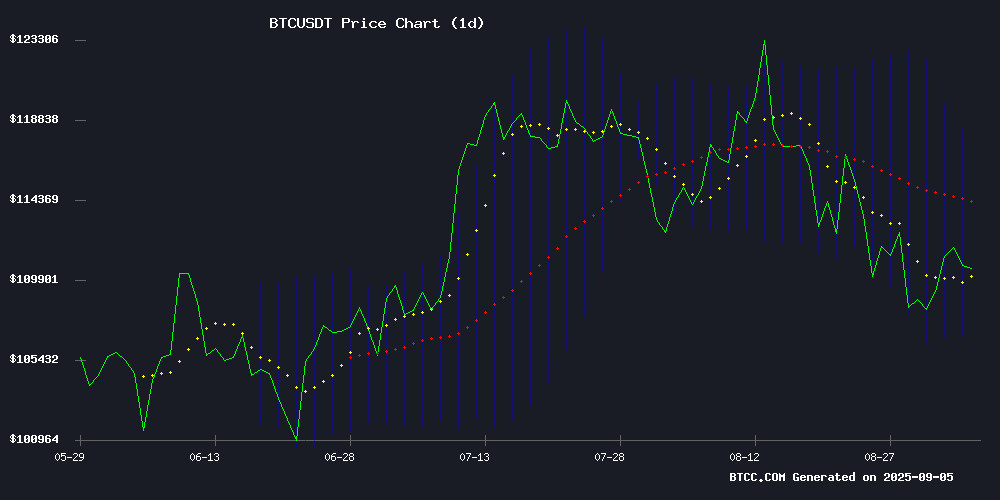

BTC is currently trading at $110,860.97, slightly below the 20-day moving average of $112,203.15, indicating potential consolidation. The MACD reading of 100.7054 suggests positive momentum as the signal line remains above the histogram. Bollinger Bands show price action NEAR the middle band with upper resistance at $117,567.51 and strong support at $106,838.79. According to BTCC financial analyst Robert, 'The technical setup suggests BTC is building a solid foundation above the $106K support level, which could propel it toward higher resistance zones in the coming weeks.'

Market Sentiment: Institutional Adoption and Macro Factors Support BTC Rally

Recent developments including US Bank's revived Bitcoin custody services through NYDIG and Saylor's Bitcoin-backed strategy nearing S&P 500 inclusion with $70B exposure demonstrate growing institutional confidence. The weak U.S. jobs report has increased expectations for Fed rate cuts, traditionally positive for Bitcoin. Tether and El Salvador's gold-backed initiatives further strengthen Bitcoin's store-of-value narrative. BTCC financial analyst Robert notes, 'The convergence of institutional adoption, favorable monetary policy expectations, and strategic partnerships creates a fundamentally strong environment for Bitcoin's continued appreciation.'

Factors Influencing BTC's Price

US Bank Revives Bitcoin Custody Services Through NYDIG Partnership

US Bank, the fifth-largest commercial bank in the United States, has reentered the cryptocurrency custody arena after a four-year hiatus. The institution now offers Bitcoin custody and ETF support for institutional investment managers, signaling renewed confidence in digital assets amid a softening regulatory landscape.

The bank initially launched crypto custody in 2021 before halting operations due to SEC accounting rules that forced balance sheet recognition of digital assets. Recent regulatory rollbacks under the Trump administration, including the Federal Reserve's termination of its crypto monitoring program, have cleared the path for this comeback.

Saylor’s Bitcoin-Backed ‘Strategy’ Nears S&P 500 Inclusion with $70B BTC Exposure

Michael Saylor's MicroStrategy (MSTR) has cleared all eligibility hurdles for S&P 500 inclusion, marking a watershed moment for Bitcoin's institutional adoption. The company's latest quarterly earnings revealed $14 billion in unrealized Bitcoin gains, fulfilling the index's profitability requirements after four consecutive quarters of positive results.

The enterprise software firm turned corporate Bitcoin vault now carries nearly $70 billion in BTC exposure. Its stock has surged 161% over the past year, directly mirroring Bitcoin's price trajectory. This transformation reflects Saylor's controversial strategy of leveraging debt and equity offerings to accumulate cryptocurrency reserves.

Inclusion would force passive funds tracking the S&P 500 to purchase approximately 50 million MSTR shares worth $16 billion. Pension funds and institutional investors would effectively become indirect Bitcoin holders overnight—a tectonic shift for digital asset adoption in traditional finance.

Tether and El Salvador Strengthen Ties to Gold, Seen as 'Natural Bitcoin'

Tether, the dominant stablecoin issuer, is exploring investments in gold mining and royalty firms, building on its existing $8.7 billion bullion holdings. The company has engaged in talks with industry players across mining, refining, and trading sectors. CEO Paolo Ardoino has long championed gold as "the natural Bitcoin," framing it as a foundational asset in the event of a global financial reset.

El Salvador has made its first central bank gold purchase since 1990, acquiring nearly 14,000 ounces for $50 million. The move aligns with President Nayib Bukele's unorthodox economic strategies, which previously included adopting Bitcoin as legal tender.

Tether is expanding its gold sector footprint with a planned $100 million investment to increase its stake in Elemental Altus Royalties, a Canadian firm specializing in gold mine revenue streams. The stablecoin giant's pivot toward hard assets reflects growing institutional interest in tangible stores of value amid macroeconomic uncertainty.

Weak U.S. Jobs Report Spurs Market Bets on Fed Rate Cut, Bitcoin Rises

The U.S. labor market showed unexpected weakness in August, with nonfarm payrolls adding just 22,000 jobs—far below the 75,000 forecast. Unemployment edged up to 4.3%, reinforcing expectations of a Federal Reserve rate cut in September. Financial markets reacted swiftly: Bitcoin gained $500 to $112,800 within minutes, while gold surged 1% to a record $3,644/oz.

Treasury yields fell six basis points as the dollar weakened. The jobs miss follows Bitcoin's recent retreat from its mid-August peak above $124,000, highlighting its sensitivity to macroeconomic shifts. Fed Chair Jerome Powell's dovish tilt further fuels speculation of looser monetary policy ahead.

Chinese Miner Cango Reports Surge in Bitcoin Output Amid Strategic US Expansion

Cango, a Chinese Bitcoin miner, posted a significant increase in production during Q2 2025, mining 1,404.4 BTC—bringing its cumulative output to 3,879.2 BTC since inception. Despite revenue of RMB 1 billion ($139.8 million), the company reported a net loss of RMB 2.1 billion ($295.4 million), reversing a year-earlier profit.

The firm's average cost per coin stood at $83,091, excluding depreciation, while total expenses climbed to $98,636 after additional outlays. Adjusted EBITDA reached RMB 710.1 million ($99.1 million), reflecting robust operational performance.

Cango expanded its mining capacity to 50 EH/s via an 18 EH/s acquisition, driving a 44% month-on-month production jump to 650.5 BTC in July. CEO Paul Yu highlighted the success of its asset-light strategy, emphasizing plug-and-play rig acquisitions over heavy infrastructure to accelerate scaling.

Eric Trump-Backed American Bitcoin Debuts on Nasdaq with Volatile Trading

American Bitcoin, a cryptocurrency mining venture supported by Eric Trump and Donald Trump Jr., made its Nasdaq debut through a merger with a small-cap miner, bypassing the traditional IPO route. The stock opened at $8, peaked at $13, and settled near $10 on its first day, briefly achieving a $7.5 billion market valuation before dropping to $6.35 by Thursday midday.

Eric Trump framed the project as distinct from typical crypto treasury plays, calling it "my baby" in a Financial Times interview. The company's three-pronged strategy includes Bitcoin mining, accumulation through public-market access, and value amplification via the Trump brand.

The launch drew immediate scrutiny, with critics on social media comparing $ABTC to other controversial celebrity-linked tokens. Market observers now question whether the Trump name can sustain long-term value in the volatile crypto mining sector.

Bitcoin Holds Steady at $112K Amid Market Uncertainty

Bitcoin maintained its position at $112,364 on Friday, with a market capitalization of $2.23 trillion. The cryptocurrency's 24-hour trading volume reached $42.90 billion, as prices fluctuated between $109,399 and $112,965. Despite showing resilience, Bitcoin remains below critical resistance levels, signaling caution for investors.

Trading volume, often seen as a barometer of market health, has yet to confirm a macro reversal. The lack of substantial activity suggests investor hesitancy, possibly due to broader economic uncertainties or geopolitical tensions. Market experts view the current phase as consolidation, with Bitcoin potentially gearing up for a decisive move once volume picks up.

Rising Global Liquidity Suggests More Upside for Bitcoin

Global money supply (M2) growth indicates expanding liquidity from major central banks, a factor historically correlated with Bitcoin's price performance. The cryptocurrency shows a 0.94 long-term correlation with worldwide liquidity measures.

Despite recent pullbacks from record highs, current monetary conditions suggest continued upside potential for Bitcoin in this bull cycle. The token's sensitivity to liquidity stems from its role as a hedge against currency debasement and store of value.

Worldwide liquidity encompasses cash, deposits, and near-money assets - all currently experiencing expansionary pressures from accommodative monetary policies across developed economies.

Trump-Backed American Bitcoin Mining Stock Surges 16% in Volatile Debut

American Bitcoin, a cryptocurrency mining firm endorsed by Eric Trump and Donald Trump Jr., made a turbulent entry into public markets with a 16% closing gain on its first trading day. The stock, trading under the ticker ABTC on Nasdaq, initially skyrocketed 91% to $13.20 before paring gains amid five trading halts triggered by extreme volatility.

The company emerged from a merger with Gryphon Digital Mining, with shares ultimately settling at $8—a 16.5% premium to Gryphon's last close. After-hours trading pushed the price to $8.45, cementing its status as one of the year's most scrutinized crypto-equity crossovers.

This debut underscores the high-risk convergence of political influence and digital assets, coming days after another Trump-affiliated crypto venture, World Liberty Financial, began exchange trading. The wild price swings—from $13.20 highs to $6.72 lows—reflect the speculative frenzy surrounding politically connected crypto ventures.

Will BTC Price Hit 200000?

Based on current technical indicators and fundamental developments, reaching $200,000 is a realistic medium-term target for BTC. The combination of strong institutional adoption, favorable macroeconomic conditions, and technical consolidation above key support levels creates a bullish setup.

| Factor | Current Status | Projected Impact |

|---|---|---|

| Price vs 20-day MA | $110,860.97 (slightly below) | Consolidation before breakout |

| MACD Momentum | 100.7054 (positive) | Continuing upward trend |

| Institutional Adoption | Growing (US Bank, S&P inclusion talk) | Increased demand pressure |

| Macro Environment | Rate cut expectations | Favorable for risk assets |

BTCC financial analyst Robert emphasizes that 'While short-term volatility is expected, the structural drivers supporting Bitcoin's value proposition have never been stronger, making the $200K target achievable within the current market cycle.'